1 // Start Saving for a Down Payment

Although it’s common to put 20%, the amount you decide to pay upfront varies. We understand that even a small down payment can be a hefty amount. For example, a 5% down payment on a $250,000 home is $12,500. If you’re not quite making the salary you’re expecting to make, first time home buyer programs allow as little as 3% down. However, keep in mind that a smaller down payment means higher monthly mortgages.

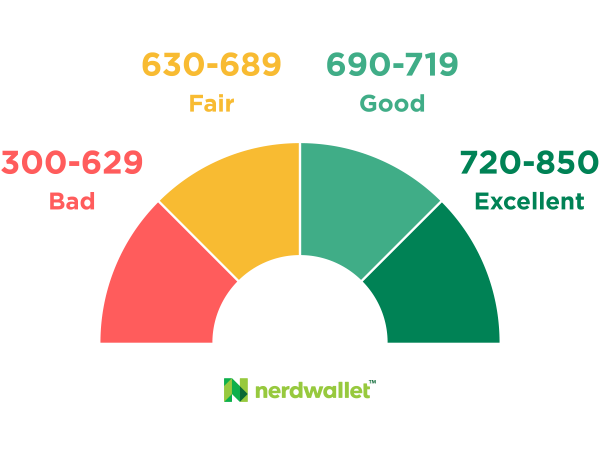

We recommend using our Mortgage Calculator to help you navigate your preferred monthly payments. Using budgeting apps such as Nerd Wallet will also keep you on track aligning your financial goals.

2 // Get Familiar With Closing Costs

A rookie mistake in purchasing a home is not having saved up enough for closing costs. These cost may include fees for an attorney, a title search, title insurance, taxes, lender costs and some upfront housing expenses such as homeowners insurance. The amount a buyer will pay in closing costs varies based on the size of the loan and local taxes and fees, but a general rule is that they average 2% to 5% of the purchase price.

We recomend taking advantage of any incentives a seller is offering to help lower these cost. Currently we’re offering our Year-End Incentive: Washer, Dryer and Fridge Included PLUS $5,000 Towards Closing Costs and/or Upgrades for Closings on/or before December 31, 2019

4 // Pick the Right Neighborhood

If you plan on raising children it’s important to research surrounding school districts to ensure they get a high-quality education. Even if you’re not, surrounding schools affect property values. Being nearby grocery stores, restaurants and stores allow you to decrease your spending in transportation costs and make for a convenient location.